Canadian taxation on stock options

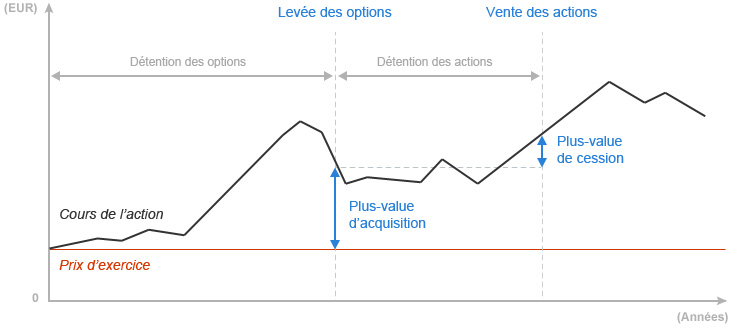

Any increase decrease in value subsequent to the date of acquisition will be taxed as a capital gain loss in the year of disposal.

The same tax treatment applies to options granted by mutual fund trusts. If a stock option plan pertains to shares of a CCPC, the amount of the benefit is normally taxable as employment income in the year of disposal of the shares. In such a situation, the employee is entitled to the above-mentioned deductions provided the shares are kept for at least two years, even if the price paid for the shares is less than their FMV forex trading los angeles the date the stock option is granted.

Employee Stock Options

In JuneJohn exercises his option. There are no tax consequences in when the option canadian taxation on stock options granted.

Canadian Tax Treatment of Employee Stock Options| Tax Assessment

There is no taxable benefit for John in because ABC is a CCPC and the gain on the shares qualifies for the deferral. Unfortunately, the loss on the disposition of the shares cannot be applied to reduce the taxable benefit.

Stock Options - Tax Planning Guide RSS Twitter Facebook LinkedIn Google Plus. Tax planning guide Section 1 - Tax System Section 2 — Individuals and Families Section 3 - Education Section 4 - Health, Seniors and Caregivers Section 5 - Employees Section 5 Introduction Taxable Benefits Tax Credit — Federal Stock Options Shares of Canadian-Controlled Private Corporations Employment Deduction — Quebec Non-Taxable Benefits Employment Expenses Incentives for Workers Tips — Quebec New Graduates Working in Region - Quebec Foreign Specialists - Quebec Volunteer Firefighters and Search and Rescue Volunteer GST, HST and QST Refund Salary Deferrals Section 6 - Businesses Section 7 - Investments Section 8 - Retirement Assistance Programs Section 9 - Visitors to the U.