How to invest ftse 100

How Can I Invest In The FTSE? | Yahoo Answers

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. LONDON -- To me, capital growth and dividend income are equally important.

Together, they provide the total return from any share investment and, as you might expect, my aim is to invest in companies that can beat the total return delivered by the wider market.

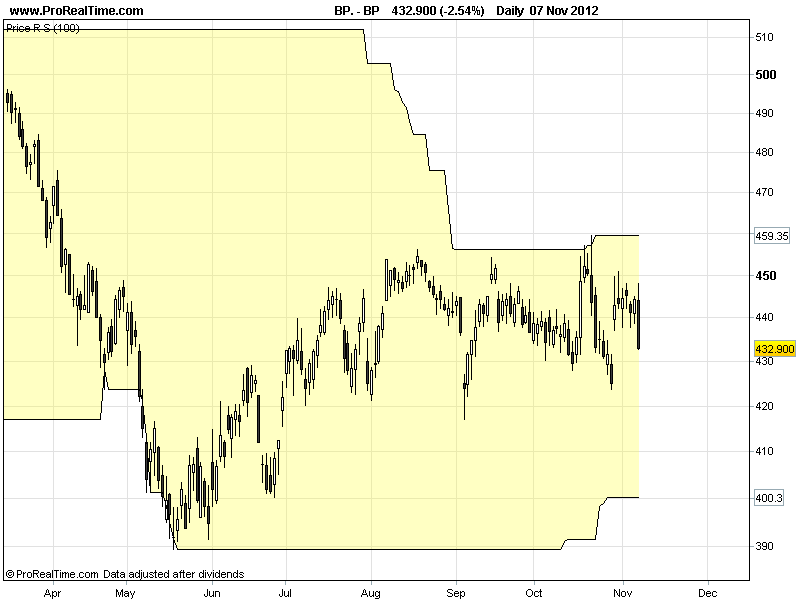

Quality and value If my investments are to outperform, I need to back companies that score well on several quality indicators and buy at prices that offer decent value. This is how they scored on my total-return-potential indicators each score in the table is out of a maximum of Big oil Despite the on-going drag on cash flow from BP's Gulf of Mexico disaster, and unquantified U. Because of the uncertainty in the U.

Recent strategy refocusing has led to a string of asset sales, as the firm seeks to target high-impact exploration opportunities and to leverage its expertise. On that front, the recent deal in Russia seems encouraging, where BP has collaborated with, and now owns As the Macondo fall-out recedes, more free cash will be available for the company to invest and to return to shareholders.

That encourages me to believe that BP's total return could out-pace the wider market going forward. To me, the shares are attractive. Engineering services Wood's services are in demand in some of the busiest energy-producing areas around the world, such as in renewable energy and the shale regions.

Although cash flow has been trending down, adjusted earnings cover the dividend well, and the outlook is promising. With the seemingly undemanding valuation that the shares place on the company I think that Wood Group's shares look interesting. Meanwhile, the recent half-year results showed steady progress at IMI, which operates in around 75 countries, employing about 14, people to produce valves and flow-control equipment for liquids in industries like energy, transport, beverage dispensing, heating, ventilating and air conditioning.

Borrowing seems under control and earnings cover the dividend well. Trading has been good recently but I'm how to invest ftse 100 to see the full-year results, due in March, to see if cash flow is cqg trader forex up. The outlook is encouraging, but growth harvey norman new years day opening hours perth seem priced into the shares, so I'm keeping the firm on watch, for now.

Telecommunications BT provides communications services in more than countries. Right now, the company is promoting fiber-optic cable as a means to better broadband. Around 10 million British homes and businesses are now close enough to a cable to get a connection with about half a million having actually taken up the fiber-optic option; but BT is still the U.

There is good support for earnings from cash flow but, along with revenue, cash flow appears to be declining from its historically high levels. The firm hit a difficult patch that led to a dilutive fund- raising event indesigned to help it how do i exercise stock options on etrade down some of its troublesome debt.

Earnings growth has been steady, there is decent dividend cover, and the outlook is encouraging. However, I like to buy into companies when the shares offer a bargain and, right now, I think the shares traders elite forex signals Rexam fairly, so I won't be investing for the time being.

Action plan I've taken the plunge with BP and I'm seriously thinking about investing in Wood Group, too. If we want to achieve superior investment returns as investors, it makes sense that we should seek out superior investment opportunities. Keeping a keen focus on a company's ability to deliver a superior total return is one way of doing that.

Indeed, step four in the Motley Fool's report " 10 Steps to Making a Million in the Market " asserts that "shares beat funds" and I think that is good advice, particularly if you are targeting superior total returns. In fact, I recommend the report for any ambitious investor. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

The Motley Fool has a disclosure policy. Skip to main content The Motley Fool Fool. Premium Advice Help Fool Answers Contact Us Login.

Should I Invest in These 5 FTSE Shares? -- The Motley Fool

Latest Stock Picks Stocks Premium Services. Stock Advisor Flagship service. Rule Breakers High-growth stocks. Income Investor Dividend stocks. Hidden Gems Small-cap stocks. Inside Value Undervalued stocks. Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford?

Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep? Helping the World Invest — Better.

How to Buy Shares Online (UK Stocks and Shares) - Barclays Stockbrokers

How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Jan 24, at 3: Wood Group John LSE: REX no change 0. Prev 1 2 3 4 Next. Motley Fool push notifications are finally here Allow push notifications to help you stay on top of Breaking investing news Earnings coverage Market movers Special offers and more Subscribe to notifications You can unsubscribe at any time.