The relationship between the stock market crash and the great depression

Did the Stock Market Crash of effectively cause the Great Depression, or were there economic factors already in place at that time such that the Greet Depression would have happened anyway, and the Stock Market Crash was just a result of those factors and made things worse? What do "contemporary" to economic writers such as Milton Friedman and John Kenneth Galbraith have to say about the connection between the stock market crash and the Great Depression?

Or modern "Depressionists" such as Nouriel Roubini or Jim Grant? The stock market crash was most likely a serious contributory factor in the onset of the Great Depression. However, it did not "effectively cause" the economy to implode - there were serious pre-existing weaknesses in the late s economy. In fact a recession was already brewing before the stock market had even crashed. Production of industrial products, for the moment, had outrun consumer and investment demand for them.

The most likely reason is that business concerns, in the characteristic enthusiasm of good times, misjudged the prospective increase in demand and acquired larger inventories than they later found they needed. As a result they curtailed their buying, and this led to a cutback in production. In short, the summer of marked the beginning of the familiar inventory recession.

The Great Crash, Houghton Mifflin Harcourt, Although the two events are definitely linked, it is not a cause and effect relationship. It is probably more accurate to call the crash the start of the era of Great Depression.

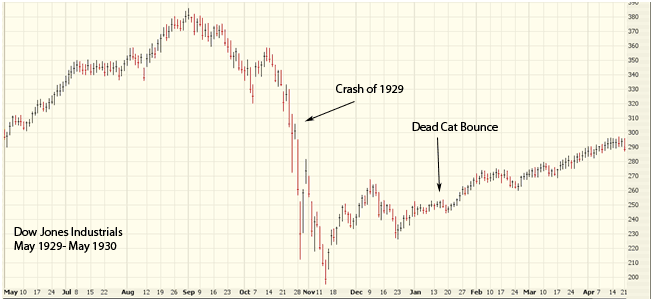

People who are not economists often view the Great Crash and the Great Depression as the same event In contrast, many economists believe that the two events are at most tangentially related. Economic fundamentals had been declining appreciably months before Black Thursday and Tuesday. Industrial output had been on a steady downward tend since June, and automobile production in particular faced a collapse. Prices and income both dropped after August. Industrial production fell from in June to in September to in October, in November, and 99 in December; automobile production declined from , units in March to , in August, , in October, and 92, in December.

Manias, Panics and Crashes: A History of Financial Crises. It is thus plausible to argue a recession was already in progress by the time Wall Street buckled. A conventional view is that after years of intense speculation , the bubble was ready to burst. According to the accepted view of events, by the autumn of the economy was well into a depression A penetrating student of the economic behavior of this period has said that the market slump, "reflected, in the main, the change which was already apparent in the industrial situation.

What was the relationship between the stock market crash and the great depression? | Yahoo Answers

Even if the contraction had come to an end in late or early , as it might have done in the absence of the monetary collapse that was to ensue, it would have ranked as one of the more severe contractions on record. The Great Contraction, Princeton University Press, Whether these economic woes actually caused the crash is quite disputed.

Some argue, for instance, that contemporaries could reasonably have believed the market would soon vigorously rebound. Respected voices at the time had opined that stocks were undervalued, and previous dips proved transient.

There were no reasons for expecting disaster. No one could foresee that production, prices, incomes, and all other indicators would continue to shrink through three long and dismal years A depression, serious or otherwise, could not be foreseen when the market fell. Others go further and argue the economic situation was fundamentally sound typically, arguing that the central bank killed a free market recovery and caused the real Great Depression.

This is probably a bit detached from reality, though. While the economic downturn predated the crash, it intensified in its aftermath. Prior to it, the decline in economic metrics could be reasonably dismissed as a temporary dip. The dramatic collapse of stock values created an extreme shock to confidence, and made the once-rosy future seem much less certain. Some writers argue that, in this sense, it helped made the subsequent Great Depression worse.

But partly also, [the stock market's crash] must have helped to deepen the contraction. It changed the atmosphere within which businessmen and others were making their plans, and spread uncertainty where dazzling hopes for a new era had prevailed. It is commonly believed that it reduced the willingness of both consumers and business enterprises to spend.

The destruction of consumer and business confidence led to inhibited spending. This created a vicious cycle as production fell together with demand, depressing economic activity even further. This decline in spending then drove down aggregate income through a standard Keynesian mechanism or, conceivably, through effects on the real interest rate and the supply of labor. This does not mean that the Crash of "effectively" caused the Great Depression. However, it certainly helped worsen its effects, especially in the immediate aftermath.

Thus, while the Great Crash of the stock market and the Great Depression are two quite separate events, the decline in stock prices was one factor causing the decline in production and employment in the United States. I am writing as the author of "A Modern Approach to Graham and Dodd Investing. Published in , the book discussed the crash and predicted another one which occurred in It also provided a road map of how "other events" caused the fallout from the crash to turn into the Great Depression, and why the absence of such events have so far failed to produce a similar result this time around.

During and , it looked like what would become the Great Depression would be nothing more than a severe recession. In the fall of the latter year, President Herbert Hoover predicted that 'Prosperity is just around the corner," possibly with good reason.

But the seminal event that turned the retreat into a global economic collapse was the collapse of the Credit Anstalt Bank in Austria, which plunged Europe deeper into a decade-long Depression The Credit Anstalt was actually the largest "offshore" bank of Germany, which at the time, was the world's second largest economy, meaning that it was a case of "when Germany sneezes, Europe catches cold.

The "fall guy" could be the Taiwan Trust Bank or the Korea Savings Bank. These are made-up names to illustrate places where the trouble is likely to occur. The consequences will be severe for the whole region, but particularly for China" [now the second largest economy in the world].

1929 Depression Wall Street Stock Market CrashFurthermore, Ben Bernanke, the outgoing chairman of the Federal Reserve, was a student of the Great Depression, and adopted policies of "quantitative easing" that might have been foolish at some other time, but were peculiarly suited for the "modern s," in contrast to the Fed's tight money policies in the original s. Specifically, the Fed and the Administration adopted monetary and fiscal policies that were more akin to those of World War II than to those of the s.

Some bad luck and bad economic policy took an inherently tough situation after and made it into something far worse. Well, it certainly was not a result, because it happened well before the "Great Depression" which didn't really get going until A lot of people think the "Depression" began in , but this is not really true.

The Great Depression - The Stock Market Crash and Beyond

The bread lines and high unemployment actually did not become significant until Before then the "crisis" was financial, mainly affecting businesses, kind of like , not ordinary people.

There were two major factors in creating the depression: In the s, Congress instituted a series of extremely high tariffs through the Smoot-Harley Act and other measures. This created a global trade war which was very damaging to the world's economy. During the s, the Republicans controlled Congress and kept taxes low, much lower than they are today.

united states - Was the Stock Market Crash of a cause or result of the Great Depression? - History Stack Exchange

Most Americans, including the wealthiest, had little to no income tax at all. This was very conducive to investment. Many business owners fled the country like "Rick" in Casablanca and others simply retired and shut down.

This had a devastating effect on the economy. Essentially the economy shut down because everyone with capital stopped investing. It was pointless to build a business if you would just lose all your money to taxes. Businesses like restaurants and jewelry stores practically went extinct. Just buying a wedding a ring became difficult. Larger businesses all contracted and stopped hiring, leading to massive unemployment.

Thus, the crash was, in a sense "the cause" because it changed the mood in the country, leading to foolish decisions, such as to raise tariffs and tax rates, but the proximate cause was the actual institution of those decisions.

By posting your answer, you agree to the privacy policy and terms of service. Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered.

History Stack Exchange is a question and answer site for historians and history buffs.

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. Was the Stock Market Crash of a cause or result of the Great Depression? The way its phrased, I feel like there's really three questions combined into one here: I have made the question more objective, and hopefully more answerable, by asking for the views of economic writers, and was wondering if the question can be re-opened in its current form.

Our great depression is our lives. TylerDurden Hey, no quoting yourself! Did the Stock Market Crash of effectively cause the Great Depression?

Were there economic factors already in place? Was the Stock Market Crash just a result of those factors? Did the Stock Market Crash. Great answer -- covers all my questions. Also the financial crisis did affect normal people - it's called foreclosure.

Generally that answer would benefit from sources. Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. History Stack Exchange works best with JavaScript enabled. This is really a subject on which entire books have been written. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3.

Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.