Earnings cycle stock market

If you look at the recent history, you can see clearly that growth has plateaued.

Stock Market Elliott Wave Count, Economic Cycle and Equities Cycle - ETF Forecasts, Swing Trades & Long Term Investing Signals

And it's a theme that Wells Capital Management's Jim Paulsen warns "could become problematic" for stock-market investors. Corporate profitability recovered smartly during the early years of this recovery, but similar to past cycles, has slowed in recent years.

This isn't exactly news. But analysts are becoming increasingly vocal about this.

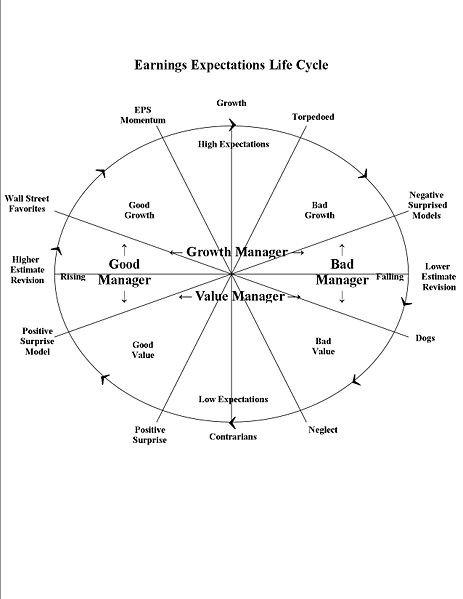

Stock Market Earnings Preview 2012 Part 2After all, earnings and expectations for earnings growth are the most important drivers of stock prices. On Friday, Deutsche Bank's David Bianco pointed out that if you consider GAAP earnings — that's the earnings figure that doesn't exclude adjustments that companies make to smooth out the numbers — earnings are actually declining.

Earnings Season Warning: It's Not Only Stock Market Valuations That Are Inflated! - SPDR S&P Trust ETF (NYSEARCA:SPY) | Seeking Alpha

This may come as a surprise to everyone as they watch jobs grow, unemployment come down, auto sales surge, home prices rally, and stock prices sit near record levels.

But when everything's great, it's reasonable to be concerned that we're near the top.

Indeed, Goldman Sachs' David Kostin was "surprised" to hear clients asking about the prospect for a US recession in That clean GAAP earnings line is already showing negative growth. Like Paulsen said, this "could become problematic," especially since the stock market is trading at historically high valuations.

Earnings Season

Should global growth remain tepid and overall sales results modest, since profit margins are unlikely to rise much, earnings trends will also likely prove disappointing. Conversely, should global growth and corporate sales results accelerate, because the US is nearing full employment, companies may soon face cost-push pressures and margin erosion, which will likely offset improved sales results.

Paulsen and Bianco , both veteran stock-market strategists, have been dubbed "perma-bulls" at one point or another. None of what they have been saying lately has been very "perma-bullish. Why big data can make HR more important.

You are using an outdated version of Internet Explorer. For security reasons you should upgrade your browser.

Please go to Windows Updates and install the latest version. Trending Tech Finance Politics Strategy Lifestyle Sports Video All. You have successfully emailed the post.

Stock Market: Secular Cycles, P/E, and Market Volatility

This is a problem. How much sex you should be having in a healthy relationship. Chart Of The Day Bearish Earnings David Bianco Jim Paulsen. Recommended For You Powered by Sailthru. This is a problem This is a problem How much more can corporate earnings grow? Featured Why big data can make HR more important. Thanks to our partners. Registration on or use of this site constitutes acceptance of our Terms of Service , Privacy Policy , and Cookie Policy.

Stock quotes by finanzen.