Restricted stock award tax implications

Your browser is too old!

Upgrade to a different browser or install Google Chrome Frame to experience this site. Bringing Deeper Meaning to Business and the Business of Accounting.

Restricted stock awards are a popular replacement for stock option grants. The reason is that the awards typically retain their value if the price of the stock drops.

Shares vs Stock Options | Mike Volker – Vancouver's Green Angel and Tech Innovator

The company simply needs to award additional restricted shares. Stock options on the other hand lose most or all of their value if the underlying stock goes down in price However, there are federal income and employment tax implications for restricted stock awards. In a typical restricted stock arrangement, an executive receives company stock subject to one or more restrictions.

The most common restriction is a requirement for continued employment through a designated date. Often, the stock is transferred at no or minimal cost. The right to keep the shares is forfeited if the executive fails to fulfill the terms. When the restricted stock is received, the recipient recognizes income for federal tax purposes in one of two ways:. Without Section 83 b Election: The restricted stock award results in the recognition of ordinary compensation income in the year the restriction causing the substantial risk of forfeiture lapses.

Federal income tax and federal employment taxes must be paid on the amount treated as compensation. With Section 83 b Election: A recipient can make a Section 83 b election to recognize income on the date the restricted shares are received. This accelerates the tax effects for both the executive and the employer.

The election must be made either before the share transfer or within 30 days after the share transfer. Any stock appreciation between the date of the award and the date of the vesting is treated as high-taxed ordinary income from compensation. Alternatively, the executive can make a Section 83 b election to be taxed when the stock is awarded.

Stock Plan Resource Center | belucydyret.web.fc2.com

Any subsequent appreciation is treated as capital gain, which will qualify for preferential tax rates if the stock is held for more than one year. The tax rates will be much lower than the maximum rate on ordinary income from compensation. The downside is that the executive must recognize taxable income at the time of the restricted stock award even though the restricted stock may later be forfeited or decline in value.

For federal income and employment tax purposes, stock is considered to be restricted meaning not vested when both of the following conditions are met. Subject to a Substantial Risk of Forfeiture: This condition is met if full ownership of the stock depends on the future performance, or refraining from the performance, of substantial services by the recipient executive.

This condition is met if the recipient transfers any interest in the stock to any person or entity other than the employer. For instance, stock meets the not-transferable requirement if the recipient can sell it, but the new holder must still forfeit the stock upon the occurrence of the event causing the substantial risk of forfeiture.

To ensure that any subsequent holder is aware of the restriction s and the non-transferable requirement is met, the shares are commonly stamped with a legend that discloses that information. Stock is subject to a substantial risk of forfeiture if the rights to full ownership depend directly or indirectly on either. Your employer transfers 10, shares to you. Under the terms of the deal, you must forfeit the shares back to your employer if you leave the company for any reason before three years after the date of the transfer.

Restricted Stock & RSUs: Key Aspects to KnowIf you sell the shares, whoever buys them must also forfeit them if you leave the company before the magic date. Since you must perform substantial services over the next three years to gain full ownership of the stock, the shares are considered subject to a substantial risk of forfeiture.

As a result, the shares are considered restricted stock and are subject to the income and withholding tax considerations. The tax rules for restricted stock are fairly straightforward.

The major tax planning consideration for the executive is deciding whether or not to make a Section 83 b election. In many cases, the risks of making the election will be perceived as greater than the potential tax-saving benefit, but you should consult your tax adviser before making that call.

But deeper than dollars and data, our focus is on developing an understanding of you, your culture and your business goals.

This approach enables our clients to achieve their greatest potential. Like what you read? Sign-up for our C-Suite Spotlight Program. You must be logged in to post a comment. Business is more than just numbers on a page, and we help bring those numbers to life in a way that you can understand.

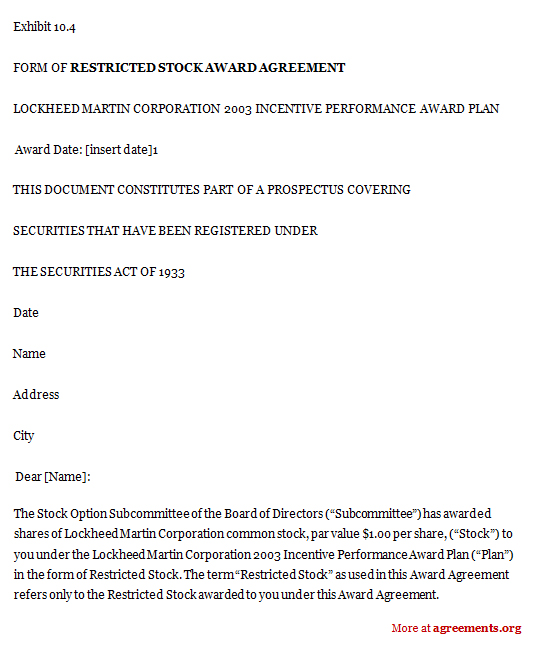

This unique approach enables you to achieve your greatest potential. We bring deeper meaning to business and the business of accounting. Click the link below to learn more about our C-Suite Spotlight program and to enter your email address to receive our weekly updates. Website designed and developed by Adventure Web Productions. Tax Implications of Restricted Stock Awards 04 29, Restricted Stock Basics In a typical restricted stock arrangement, an executive receives company stock subject to one or more restrictions.

Timing of Income Recognition When the restricted stock is received, the recipient recognizes income for federal tax purposes in one of two ways: Weighing Tax Deferral vs.

Tax Treatment of Restricted Stock Unit (RSU) Benefits | Canadian Capitalist

Requirements for Restricted Stock Treatment For federal income and employment tax purposes, stock is considered to be restricted meaning not vested when both of the following conditions are met. Substantial Risk of Forfeiture Stock is subject to a substantial risk of forfeiture if the rights to full ownership depend directly or indirectly on either.

The future performance of substantial services by the recipient, or The satisfaction of a condition related to the award. For example, the recipient may be required to obtain an advanced educational degree, or a specified professional designation, or attain a certain job status within the company for the restricted stock to become vested.

Leave a Reply Cancel reply You must be logged in to post a comment. Article Categories Advisory Audit and Accounting Construction Industry Death Care Industry Information Technology Manufacturing and Distribution Tax.

LOCATIONS Hunt Valley McCormick Road, Suite Hunt Valley, Maryland reception Fax: SIGN UP Click the link below to learn more about our C-Suite Spotlight program and to enter your email address to receive our weekly updates.