Project on impact of inflation and gdp on stock market returns in india

Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website. See our User Agreement and Privacy Policy. See our Privacy Policy and User Agreement for details.

Published on Jul 3, This project shows the relationship between Inflation and Indian Stock Market. Clipping is a handy way to collect and organize the most important slides from a presentation. You can keep your great finds in clipboards organized around topics. SlideShare Explore Search You. Project report on Relationship Of Inflation with Indian Stock Market. A study on Exchange Rates and its i Show related SlideShares at end. Rohit Kumar , Student Follow. Full Name Comment goes here.

Are you sure you want to Yes No. Kajal Nagal , Student at Icg college. Akshay Pokharkar , Student at Modern institute of business management. Shreeya Balagopal , Student at S. T Women's University at Osource India Pvt. Embeds 0 No embeds. No notes for slide. Project report on Relationship Of Inflation with Indian Stock Market 1. Rohit Kumar Roll No. This is to certify that the project report entitled of Inflation partial fulfillment of BBS. This report has not been submitted to any other organization for the award of any other Degree Rohit Kumar Bbs 3 This is to certify that the project report entitled of Inflation carrie partial fulfillment of BBS.

This report has not been submitted to any other organization for the award of any other Degree Rohit Kumar Bbs 3rd This is to certify that the project report entitled of Inflation carrie partial fulfillment of BBS. This report has not been submitted to any other organization for the award of any other Degree Rohit Kumar rd Year This is to certify that the project report entitled of Inflation carried out by Rohit Kumar partial fulfillment of BBS.

This report has not been submitted to any other organization for the award of any other Degree Rohit Kumar Year This is to certify that the project report entitled of Inflation d out by Rohit Kumar partial fulfillment of BBS. This report has not been submitted to any other organization for the award of any other Degree Rohit Kumar Year This is to certify that the project report entitled of Inflation with d out by Rohit Kumar partial fulfillment of BBS. This report has not been submitted to any other organization for the award of any other Degree Rohit Kumar Year This is to certify that the project report entitled with d out by Rohit Kumar partial fulfillment of BBS.

This report has not been submitted to any other organization for the award of any other Degree This is to certify that the project report entitled with d out by Rohit Kumar partial fulfillment of BBS. This report has not been submitted to any other organization for the award of any other Degree Dr. This report has not been submitted to any other organization for the award of any other Degree Project Supervisor This is to certify that the project report entitled is the project work at Keshav Mahavidyalaya for partial fulfillment of BBS.

IMPACT OF INFLATION AND GDP ON STOCK MARKET RETURNS IN INDIA INTRODUCTION | Thanh Thanh - belucydyret.web.fc2.com

This report has not been submitted to any other organization for the award of any other Degree Kangan Jain Project Supervisor This is to certify that the project report entitled is the project work at Keshav Mahavidyalaya for partial fulfillment of BBS. This report has not been submitted to any other organization for the award of any other Degree 3.

This research paper tries to examine the relationship of inflation with Indian stock market and also what impact inflation leave on Indian Stock Market. Further this research paper attempt to investigate to what extent inflation affects stock market. For this purpose some stock indexes are selected to see the effect of inflation. These indexes are BSE SENSEX, NSE NIFTY, BSE BANKEX, BANK NIFTY, BSE Consumer Durables, and BSE FMCG. In my research, the inflation data is taken according to CPI consumer price index.

The statistical has used in this research to do the analysis based on yearly to find out the relationship between inflation and stock market. The list of expression of thanks — no matter how extensive is always incomplete and inadequate, these acknowledgements are no exception. Therefore, I would like to thank my teacher of Finance, Ms.

Kangan Jain, for her unwavering guidance and help in completing this research project. Her suggestions and support to improve my research methodology was valuable for the completion of this project successfully.

I am also very thankful to all the people who answered my questions willingly and participated in my research for giving me their precious time. Also, I wish to thank all those authors whose journals I referred to and websites like Wikipedia and Investopedia in order to provide valuable information to complete my project. Finally, I thank my fellow students who helped me wherever I needed help, and enabled me to complete my project on time.

Rohit Kumar 6. The excessive demand, the price of final goods and services would be forced to increase and this increase give rise to inflation 7. It is generally caused by an increase in wages or an increase in the profit margin of the entrepreneurs MONETARY INFLATION Monetary inflation occur when there is an excessive supply of money.

It is understood that the government increase the money supply faster than the quantity of goods increase, which result in inflation. In developed countries they are characterized by a lack of adequate resources like capital, foreign exchange, land and infrastructure.

Furthermore, over-population with the majority depending on agriculture for livelihood means that there is a fragmentation of landholdings. There are other institutional factors like land-ownership, technological backwardness and low rate of investment in agriculture. IMPORTED INFLATION Another type of inflation is imported inflation. This occur when the inflation of goods and services from foreign countries that are experiencing inflation are imported and the increase in prices for that imported goods or services will directly affect the cost of living.

COSTS OF INFLATION Almost everyone thinks inflation is evil, but it isn't necessarily so. Inflation affects different people in different ways. It also depends on whether inflation is anticipated or unanticipated. If the inflation rate corresponds to what the majority of people are expecting anticipated inflation , then we can compensate and the cost isn't high. For example, banks can vary their interest rates and workers can negotiate contracts that include automatic wage hikes as the price level goes up.

Problems arise when there is unanticipated inflation: For those who borrow, this is similar to getting an interest-free loan. This hurts economic output in the long run. People like to complain about prices going up, but they often ignore the fact that wages should be rising as well. The question shouldn't be whether inflation is rising, but whether it's rising at a quicker pace than your wages. Finally, inflation is a sign that an economy is growing. In some situations, little inflation or even deflation can be just as bad as high inflation.

The lack of inflation may be an indication that the economy is weakening. As you can see, it's not so easy to label inflation as either good or bad - it depends on the overall economy as well as your personal situation. HOW IN FLATION IS MEASURED? Measuring inflation is a difficult problem for government statisticians. To do this, a number of goods that are representative of the economy are put together into what is referred to as a "market basket.

This results in a price index, which is the cost of the market basket today as a percentage of the cost of that identical basket in the starting year. In North America, there are two main price indexes that measure inflation: The CPI measures price change from the perspective of the purchaser.

CPI data can be found at the Bureau of Labor Statistics. Some countries like the Philippines use WPI changes as a central measure of inflation. But now India has adopted new CPI to measure inflation.

However, United States now report a producer price index instead. PPIs measure price change from the perspective of the seller. PPI data can be found at the Bureau of Labor Statistics.

You can think of price indexes as large surveys. Each month, the U. Bureau of Labor Statistics contacts thousands of retail stores, service establishments, rental units and doctors' offices to obtain price information on thousands of items used to track and measure price changes in the CPI.

They record the prices of about 80, items each month, which represent a scientifically selected sample of the prices paid by consumers for the goods and services purchased. In the long run, the various PPIs and the CPI show a similar rate of inflation.

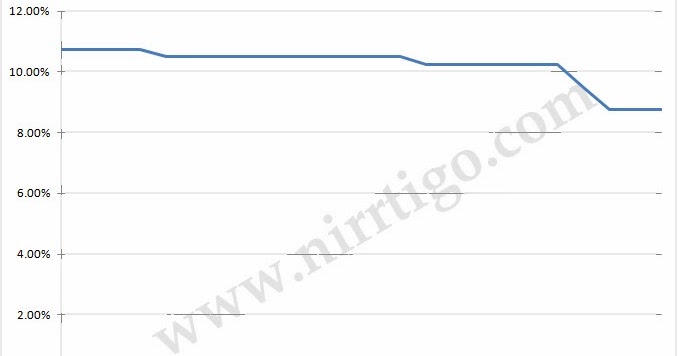

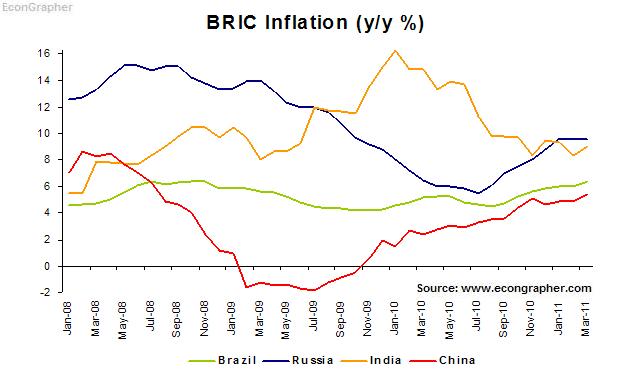

This is not the case in the short run, as PPIs often increase before the CPI. In general, investors follow the CPI more than the PPIs. This represents a modest reduction from the previous annual figure of 9. Inflation rates in India are usually quoted as changes in the Wholesale Price Index, for all commodities. Many developing countries use changes in the Consumer Price Index CPI as their central measure of inflation.

India used WPI as the measure for inflation but new CPI combined is declared as the new standard for measuring inflation April [[1] ] CPI numbers are typically measured monthly, and with a significant lag, making them unsuitable for policy use. Instead, India uses changes in the Wholesale Price Index WPI to measure its rate of inflation.

Provisional annual inflation rate based on all India general CPI Combined for November on point to point basis November over November is The corresponding provisional inflation rates for rural and urban areas for November are Inflation rates final for rural and urban areas for October are The WPI measures the price of a representative basket of wholesale goods.

In India, this basket is composed of three groups: Food Articles from the Primary Articles Group account for WPI numbers are typically measured weekly by the Ministry of Commerce and Industry.

This makes it more timely than the lagging and infrequent CPI statistic. ISSUE The challenges in developing economy are many, especially when in context of the monetary policy with the Central Bank, the inflation and price stability phenomenon.

There has been a universal argument these days when monetary policy is determined to be a key element in The Central Bank works on the objective to control and have a stable price for commodities. A good environment of price stability happens to create saving mobilization and a sustained economic growth. The former Governor of RBI C. Rangarajan points out that there is a long-term trade-off between outputand inflation.

He adds on that short-term trade-off happens to only introduce uncertainty about the price level in future. There is an agreement that the central banks have aimed to introduce the target of price stability while an argument supports it for what that means in practice. THE OPTIMAL INFLATION RATE It arises as the basis theme in deciding an adequate monetary policy.

There are two debatable proportions for an effective inflation, whether it should be in the range of per-cent as the inflation rate that persists in the industrialized economy or should it be in the range of per-cents. While deciding on the elaborate inflation rate certain problems occur regarding its measurement. The measurement bias has often calculated an inflation rate that is comparatively more than in nature.

Secondly, there often arises a problem when the quality improvements in the product are in need to be captured out, hence it affects the price index. The consumer preference for a cheaper goods affects the consumption basket at costs, for the increased expenditure on the cheaper goods takes time for the increased weight and measuring inflation.

The Boskin Commission has measured 1. The commission points out for the developed countries comprehensive study on inflation to be fairly low. MONEY SUPPLY AND INFLATION The Quantitative Easing by the central banks with the effect of an increased money supply in an economy often helps to increase or moderate inflationary targets. There is a puzzle formation between low-rate of inflation and a high growth of money supply.

When the current rate of inflation is low, a high worth of money supply warrants the tightening of liquidity and an increased interest rate for a moderate aggregate demand and the avoidance of any potential problems. Further, in case of a low output a tightened monetary policy would affect the production in a much more severe manner.

The supply shocks have known to play a dominant role in the regard of monetary policy. The bumper harvest in with a buffer yield in wheat, sugarcane, and pulses had led to an early supply condition further driving their prices from what were they in the last year.

The increased import competition These cost-saving driven technologies have often helped to drive a low-inflation rate. The normal growth cycles accompanied with the international price pressures has several times being characterized by domestic uncertainties. GLOBAL TRADE Inflation in India generally occurs as a consequence of global traded commodities and the several efforts made by The Reserve Bank of India to weaken rupee against dollar.

This was done after the Pokhran Blasts in According to some experts the policy of RBI to absorb all dollars coming into the Indian Economy contributes to the appreciation of the rupee. The RBI picture clearly portrays forsubsidizing exports with a weak dollar-exchange rate.

All these account for a dangerous inflationary policies being followed by the central bankof the country. FACTORS There are several factors which help to determine the inflationary impact in the country and further help in making a comparative analysis of the policies for the same.

The major determinant of the inflation in regard to the employment generation and growth is depicted by the Phillips curve. DEMAND FACTORS It basically occurs in a situation when the aggregate demand in the economy has exceeded the aggregate supply.

It could further be described as a situation where too much money chases just few goods. A country has a capacity of producing just units of a commodity but the actual demand in the country is units. Hence, as a result of which due to scarcity in supply the prices of the commodity rises.

This has generally been seen in India in context with the agrarian society where due to droughts and floods or inadequate methods for the SUPPLY FACTORS The supply side inflation is a key ingredient for the rising inflation in India. The agricultural scarcity or the damage in transit creates a scarcity causing high inflationary pressures.

Similarly, the high cost of labor eventually increases the production cost and leads to a high price for the commodity. The energies issues regarding the cost of production often increases the value of the final output produced.

These supply driven factors have basically have a fiscal tool for regulation and moderation. Further, the global level impacts of price rise often impactsinflation from the supply side of the economy. Consensus on the prime reason for the sticky and stubbornly highConsumer Price Index, that is retail inflation of India, is due to supply side constraints; and still where interest rate remains the only tool with The Reserve Bank of India. DOMESTIC FACTORS Developing economies like India have generally a lesser developed financial market which creates a weak bonding between the interest rates and the aggregate demand.

This accounts for the real money gap that could be determined as the potential determinant for the price rise and inflation in India. There is a gap in India for both the output and the real money gap. The supply of money grows rapidly while the supply of goods takes due time which causes increased inflation.

SimilarlyHoarding has been a problem of major concern in India where onions prices have shot high in the sky. There are several other stances for the gold and silver commodities and their price hike. The liberal economic perspective in India affects the domestic markets.

As the prices inUnited States Of America rises it impacts India where the commodities are now imported at a higher price impacting the price rise. Hence, the nominal exchange rate and the import inflation are a measures that depict the competitiveness and challenges for the economy.

Historically, from until , the inflation rate in India averaged 7. The inflation rate for Primary Articles is currently at 9. This breaks down into a rate 7. The inflation rate for Fuel and Power is at Finally, the inflation rate for Manufactured Articles is currently at 7. A stock market is place or public entity for buying and selling of company shares and derivatives at an agreed price.

These shares and derivatives are listed in stock exchange for trade. TYPES OF MARKET IN INDIA Primarily there are two types of market in India 1 Primary market 2 Secondary market Primary market- it is the market where stock is issued for the first time.

So, when the company is listed in stock exchange first and issues its shares- this process is happened in primary market. After IPO in primary market the trading has been done in secondary market. A Marg, Nariman Point, Mumbai Some stock exchanges have been granted exit by sebi. These stock exchanges and their date of exits are: NAME OF STOCK EXCHANGE DATE OF EXIT 1 Hyderabad Stock Exchange 25 jan, 2 Coimbatore Stock Exchange Ltd 3 april, 3 Saurashtra Kutch Stock Exchange Ltd 5 april, 4 Mangalore Stock Exchange 3 march, 5 Inter-Connected Stock Exchange Of India Ltd 8 december, 6 Cochin Stock Exchange Ltd 23 december, 7 Bangalore Stock Exchange Ltd 26 december, 8 Ludhiana Stock Exchange Ltd 30 december, 9 Gauhati Stock Exchange Ltd 27 january, 10 Bhubaneswar Stock Exchange Ltd 9 february, Two main stock exchanges in are: Bombay stock exchange and 2 NSE National stock exchange BSE: This methodology was changed in to free float market capitalization.

What are the effects of Inflation on an economy? Inflation has both Negative and Positive points which are as follows. Rising wages in turn can help fuel inflation. To tame inflation, the government usually hikes interest rates. This tends to make debt instruments attractive relative to equities as the former carry a lower risk small savings instruments are risk free as they are guaranteed by the government.

This results in some amount of investments shifting from equity to debt. However, high inflation is not always bad and low inflation need not always be good for equity markets, as the impact will differ for companies and sectors across different time horizons.

The first thing to consider is the items where prices are rising. For example a rise in oil prices will impact a wide range of items from food products to those that require transportation. How are companies affected by rising inflation and how does an investor view the impact?

A rise in prices of several items means that the input prices for production of various goods and services are rising. In these cases market analysts and fund managers will always consider the net impact on the margin of the entity that they are tracking. While there might be an increase in the input prices, it has to be considered in the backdrop of the company's ability to pass on the price hike to the end-user. If a company is able to sustain its profit margin despite high inflation, the stock price is likely to hold.

If the high inflation sustains, at some stage it will lead to a chain reaction across the economy, pushing up interest rates and even affecting demand. An increase in interest rates will push up borrowing costs for corporates while lower demand will hurt growth in revenues. This is likely to impact sentiment for the stock market as a whole.

In their research paper they tries to examine the primary factors responsible for affecting Bombay Stock Exchange in India. They attempt to investigate the relative influence of the factor affecting BSE and thereby categorized them.

In his research Douglason tries to find out the relation of Inflation and stock market in Nigeria. His research suggest that stock market returns may provide an effective hedge against in Nigeria.

In his research he explained the sharp decline in the value of the stock market and increase in the price of the owner occupied housing over the last decade, both of these were result from the interaction of increase in the expected inflation and US tax system.

The result in his research paper indicates that tax effects are large enough to account for almost the entire relative price shift which has been observed. His research paper suggest that to a large extent, the increase in the value of housing, and decrease in the value of corporate capital may have a common explanation, the interaction of inflation and a non-indexed tax system.

The acceleration of inflation has sharply increased the rate of taxation of corporate capital income, while reducing the effective taxation of owner occupied housing. His study contributes to the stock return-inflation relation literature in developing countries by revisiting the issue with reference to the emerging economy, India.

More specifically it test whether the Indian stock market provide an effective hedge against inflation using monthly data on real stock return, inflation and real activity from april to march and two step estimation procedure. The fed model postulate that the dividend or earning yield on stock equal the yield on nominal treasury bonds, or at least dividend the two should be highly correlated. They shows that the effect is consistent with modern asset pricing theory incorporating uncertainty about the real growth prospects and also habit based risk aversion.

Dueker and David C. They use latent variable VAR to estimate the impact of inflation and other macroeconomics shocks on a latent index of stock market conditions. They investigate the extent to which various shocks contribute to change in the market conditions, above and beyond their direct effect on real stock price. The specific objectives of the study are to examine whether expected and unexpected inflation has significant relationship and influence to Indian stock market of in the short run and long run for India.

It is well known fact that inflation has impact on stock returns and stock market. This research identifies that either Inflation has positive or negative relation with Indian Stock Market. To find out the relation we select six indices BSE Sensex, NSE Nifty, BSE Bankex, Bank Nifty, BSE Consumer Durables and BSE FMCG. Sensex and Nifty are the major stock indices of India, if inflation rate affect these stock indices than it affect whole stock market.

The yearly data of Inflation is available from but data of Sensex and Nifty are not available for that much longer duration. The inflation data is based on Consumer Price Index CPI and data of all indices is taken on closing date of 31 December every year. Inflation data is taken from www. So, here we need to find out what level of variation in the value of these variables can be explained by a given change in Inflation and the appropriate tool for it is regression which show the average change in the value of the dependent variable for a given value of the independent variable.

On obtaining the result through the test done, the significance value was noted, and the observations were duly noted. In later sections, these observations are then analyzed and finally the conclusions are drawn on the evidence available and test done on the data gathered.

For checking this relationship various stock indexes are selected these are: BSE Consumer Durables is used to track consumer durables product and BSE FMCG is used to track the performance of FMCG sector 1. Hypothesis- Yearly Data of Inflation and BSE Sensex Ho Null Hypothesis -Performance of BSE SENSEX does not depend on performance of inflation rate H1 Alternate Hypothesis - performance of BSE SENSEX depends on performance of inflation rate 2.

Hypothesis- Yearly Data of Inflation and NSE Nifty Ho Null Hypothesis - performance of NIFTY does not depends on performance of Inflation rate. H1 Alternate Hypothesis - performance of NIFTY depends on performance of Inflation rate Hypothesis- Yearly Data of Inflation and BSE Bankex Ho Null Hypothesis — Performance of BSE Bankex does not depend on the performance of Inflation Rate.

H1 Alternate Hypothesis - Performance of BSE Bankex depend on the performance of Inflation. Hypothesis- Yearly Data of Inflation and Bank Nifty Ho null Hypothesis - Performance of Bank Nifty does not depend on the performance of Inflation Rate.

H1 Alternate Hypothesis - Performance of Bank Nifty depend on the performance of Inflation Rate. Hypothesis- Yearly Data of Inflation and BSE Consumer Durables Ho Null Hypothesis - Performance of BSE Consumer Durables does not depend on the performance of Inflation Rate. H1 Alternate Hypothesis -Performance of BSE Consumer Durables depend on performance of Inflation Rate. Hypothesis- Yearly Data of Inflation and BSE FMCG Ho Null Hypothesis - Performance of BSE FMCG does not depend on the performance of Inflation Rate.

H1 alternate Hypothesis - Performance of BSE FMCG depend on the performance of Inflation Rate. Therefore, this section shall briefly details out first on the methodology behind computation of the various variables discussed and then about the significance of the particular value with respect to the parameters set.

Relation between Inflation and BSE Sensex So, In-order to find the relationship between Inflation and BSE Sensex and check reliability of this research. But before it is officially released, we need to conduct the following test- Test of correlation between Inflation and BSE Sensex The purpose of using correlation is because the relationship here is of quantitative in nature and so it an appropriate statistical tool for discovering and measuring the relationship and expressing it in a comprehensive manner.

The purpose of regression is to estimate the value of unknown variable from the known value of other variable. In our case the known variable is Inflation and unknown variable is BSE Sensex. Correlation is significant at the 0. All requested variables entered. Model Summary Model R R Square Adjusted R Square Std.

Error of the Estimate 1. Error Beta 1 Constant And now coming to the analysis part, the level of significance 0. But before it is officially released, we need to conduct the following test- Test of correlation between Inflation and CNX Nifty The purpose of using correlation is because the relationship here is of quantitative in nature and so it an appropriate statistical tool for discovering and measuring the relationship and expressing it in a comprehensive manner.

In our case the known variable is Inflation and unknown variable is CNX Nifty. Inflation Rate is Independent Variable CNX Nifty And Inflation Rate is Independent Variable CNX Nifty And Inflation Rate is Independent Variable CNX Nifty Inflation Rate is Independent Variable is dependent variable But before it is officially released, we need to conduct the following test- Test of correlation between Inflation and BSE Bankex The purpose of using correlation is because the relationship here is of quantitative in nature and so it an appropriate statistical tool for discovering and measuring the relationship and expressing it in a comprehensive manner.

In our case the known variable is Inflation and unknown variable is BSE Bankex. Inflation Rate is Independent Variable BSE Bankex And But before it is officially released, we need to conduct the following test- Test of correlation between Inflation and Bank Nifty The purpose of using correlation is because the relationship here is of quantitative in nature and so it an appropriate statistical tool for discovering and measuring the relationship and expressing it in a comprehensive manner.

In our case the known variable is Inflation and unknown variable is Bank Nifty. Inflation Rate is Independent Variable Bank Nifty And Inflation Rate is Independent Variable is dependent variable And But before it is officially released, we need to conduct the following test. Test of correlation between Inflation and BSE FMCG The purpose of using correlation is because the relationship here is of quantitative in nature and so it an appropriate statistical tool for discovering and measuring the relationship and expressing it in a comprehensive manner.

Project report on Relationship Of Inflation with Indian Stock Market

In our case the known variable is Inflation and unknown variable is BSE FMCG. But before it is officially released, we need to conduct the following test- Test of correlation between Inflation and BSE Consumer Durables The purpose of using correlation is because the relationship here is of quantitative in nature and so it an appropriate statistical tool for discovering and measuring the relationship and expressing it in a comprehensive manner.

In our case the known variable is Inflation and unknown variable is BSE Consumer Durables. Test of Correlation and Test of Regression conducted above, we could make out that- The correlation coefficient of Inflation with major stock indices is sometimes highly positively or sometimes very low positive.

This show the degree of association between Inflation and Various Stock Market Indices is very uncertain and random and hence stock market return cannot be predicted. So, by using above statements we can safely conclude that stock market prices follow a random walk such that outperforming the stock market is not possible The regression coefficient of Inflation with major stock market indices is always positive. This shows that inflation can be used to explain the variation in the movement of the the stock market and hence Indian Stock Market can be affected by the change in the inflation rate in Indian economy.

So, in the light of the all observation in all the above cases the results are: So, it signifies that there is significant relationship between inflation and BSE Sensex, which means that increase or decrease in inflation will increase or decrease the Sensex.

Inflation affect these two stock indices which means that inflation affect Indian Stock Market. So objective of this study has been satisfied by these results.

So It signifies that there is no signification relationship between Inflation and BSE Bankex So, it signifies that there is no significant relationship between Inflation and Bank Nifty. So it signifies that there is significant relationship but moderately significant relationship between Inflation and BSE Consumer Durables. The purpose of study was to find out the effectiveness, Impact and relationship of Inflation with the Indian Stock Market and to uncover the impact of inflation on Stock Market.

There were many objectives behind conducting the study but the main objective was to find out the nature of relationship that Indian Stock Market has with Inflation because inflation has considerable influence on economy and Stock Market The project was begin with an extensive introduction about the inflation, stock market and how inflation affect stock market and economy.

In this research the data were taken on yearly basis. The inflation data is taken on annual basis according to CPI Consumer Price Index. The data of all the indices also taken on annual basis, the data of index is taken on closing price for all years. The final result goes in favor of the study that Inflation has relationship with Indian Stock Market because Inflation shows a positive effect on most of the indices.

So, the end result is that Inflation always leave positive impact on Indian Stock Market.

Recession - Wikipedia

A study on Exchange Rates and its impact on stock prices. A project report on overview of indian stock market. Stock market project for mba finance. Effect of interest rate and exchange rate on. Start clipping No thanks.

You just clipped your first slide! Clipping is a handy way to collect important slides you want to go back to later. Now customize the name of a clipboard to store your clips. Visibility Others can see my Clipboard.