Forex night trading systems that works

Rolf Beginners , Tips , Tradeciety Academy 2 Comments 47, Views. If you still have a 9 to 5 job, becoming a professional trader in your spare time can be quite a challenge. Pursuing the goal of quitting your day job and trading full time often seems like an unrealistic task for most people, but there are certain steps that can help you improve your trading while working and finding time for hobbies and your family at the same time.

Here are our top 13 steps and tips that will help you improve your trading while still working in your regular 9 to 5 job:. The two broad categories and trading styles traders have to choose from are swing-trading vs. Usually, swing-trading is better suited for traders who have limited time and restricted access to charts throughout the day.

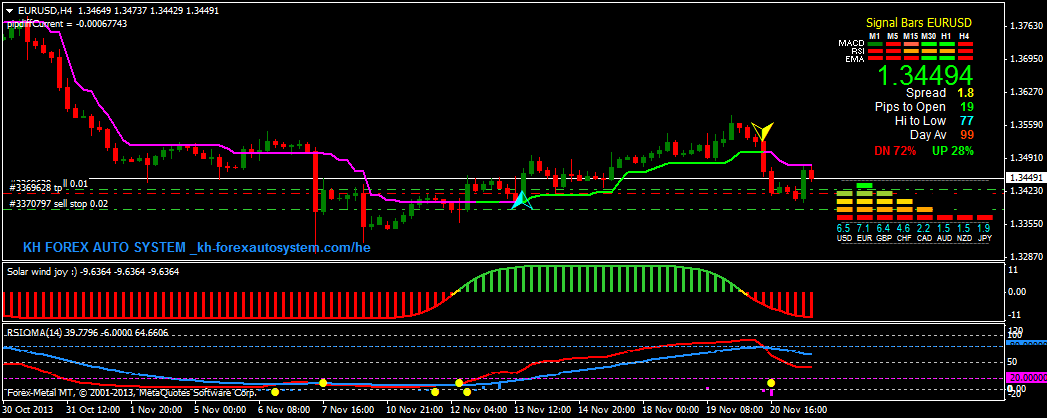

The downside, swing traders often have fewer trades and more patience is necessary. Or, depending on your time zone, even stock traders may be able to day trade a few hours in their evenings if an exchange is open at that time. ForexFactory offers a great tool that helps you understand which markets are active during different times and it also shows how liquidity changes during the day so that you can find the best currency pairs based on your schedule:.

Decide whether you want to be a swing trader or a day trader. Audit your weekly schedule and your personality to see which style suits you best. Then, choose the markets and instruments accordingly. I urge you to stop system hopping and choose your one method that you fully commit to and focus on making it work. For the next 12 months, pick one system and make a contract with yourself that you will not change your method again. Your Sunday should be your most important day of the week.

Every Sunday, I sit down and go through all the markets that I consider trading and perform a detailed chart analysis. This approach takes up a few hours of time during the weekend, but it frees up so much time during the week and it is ideal if you have a day job. It helps you stay on top of things, while being totally organized and creating a professional routine for yourself.

Price alerts are the ultimate time-saver and the most overlooked trading tool. Use them after you have done your weekend analysis. We mentioned that you should avoid system-hopping at all costs, but the question that then naturally comes up is: Traders often mistakenly believe that their lack of trading success is caused by their trading method which then usually leads to system-hopping.

Forex Night Trader | Automated Forex Trading Software & Tool | belucydyret.web.fc2.com

However, failure typically comes down to undisciplined trading, a lack of professionalism and a pure gambling mentality. Thus, the first step for you should be to identify your greatest problems and your most commonly made mistakes.

Audit your trading and take a good look at your past trades and find your greatest mistakes that cost you the most money and work on them. Traders who always try to blame their system avoid taking responsibility and look for excuses instead of doing the work that is necessary. Then come up with a top 3 list with your most commonly made mistakes.

This ties in with the previous point. Most people act from a goal-oriented mindset where they automatically connect winning trades with good trades and see losses as failures. Such a way of thinking shows an amateur mindset. The professionals, on the other hand, act from a process-oriented mindset where they look at how well they have executed their trades and how disciplined they perform.

How To Become A Profitable Trader With A 9 To 5 Job - 12 steps

Thus, for a process-oriented trader, a loss does not necessarily equal a bad trade if they have done everything they could. Professionals accept the randomness of the results and understand that over the long-term, things will work out. This will be tough but the impact will be huge. There is an interesting survey I came across and it shows how people structure their day.

The average employed American spends 7: At the same time, the average American watches 2 hours and 9 minutes TV each day and only invest 25 minutes per day in education. Also, the average sleep time is at 8 hours and 48 minutes which exceeds the recommended 8 hours per day by almost 1 hour. When you are working towards becoming a full-time trader, you have to be clear about your priorities and make sure that your actions align with your goals.

Are you willing to wake up one hour ahead of schedule every day, stop binge-watching random TV series, skip a night out with friends every now and then and re-invest that time back into your trading?

Audit your week and identify time wasters. Then, just eliminate 1 such time-waster and use it to work on your trading. I often get the question of how much you can make and how big your trading account needs to be to live off your trading profits. When I then counter with the question how much those people are currently making as traders, it becomes obvious very fast that they are focusing on the wrong things at the right time and they are not even profitable yet.

Forex21 | Forex Trading Systems & Strategies that work.

Especially at the beginning of your trading journey you should not worry about how big your annual return can be and how much capital you need to save before making the transition to trading full-time. Focusing on those things will get you off track and keep you from making progress — it can also demotivate you when you see how much work is ahead of you.

Instead, focus on your problems and struggles that you have RIGHT NOW. How can you stop losing money consistently, how can you stop repeating the same mistakes, what was the major cause for your past 30 losses, what does it take to become a break-even trader, how do you manage your risk and size your positions and so on….

Focus on the immediate task ahead and work on your current problems. Small improvements over time add up. This is another very overlooked aspect when it comes to full time trading.

Most people only focus on making more money, whereas there are two sides to the equation of being able to live off your trading:. The opposite view — controlling your expenditures: I sometimes get critiqued for this point, but mainly because traders have a completely wrong perception of full time trading and they believe that all full time traders live on yachts, drive the latest sports cars and go Rolex shopping each weekend.

You can read more about my story here. There is a place for demo trading, but most people stay on demo too long.

What I have seen in my own trading and from the traders that I helped is that demo trading often lets people adopt negative behavioral patterns that are then very hard to unlearn. This also holds true for trading with too small trading accounts and we wrote about those dangers earlier.

I typically suggest staying on demo for the first 6 — 12 months until you have a good understanding of the nuts and bolts and then take your trading to the next level.

And make sure that you learn your lessons from the first trading account s you lose! But you have to make sure that you follow the right path. Here are our top 4 tips that will help you grow your account and enjoy the process:. Always keep in mind that what you are doing is creating a new life and a new career for you. You have to get away from the get rich quick mentality and accept that this is a long-term play.

When trading is not your only source of income, you can eliminate a lot of the pressure that often causes traders to make mistakes. I have talked to many traders who enjoy their day job and pursue their trading as a side business where they find an additional challenge to their regular routine, while earning some complimentary income. Understand your motives and become self-aware about how you perform best while achieving your life goals. The cold, harsh truth is that, in the end, no one cares if you make it as a trader.

Analyze your approach to trading realistically, your level of professionalism and whether you are serious enough about it, or whether you are just trying to get lucky and find a Holy Grail system. Are you serious enough about trading? Be honest with yourself and evaluate your current approach to trading.

Your email address will not be published. Trading Resources Tradeciety Academy About us Contact Webmasters. Tradeciety — Trading tips, technical analysis, free trading tools Forex Trading Blog And Trading Academy. Trading Blog Technical Analysis Market Analysis Indicators Price Action Psychology Beginners Risk Management Statistics Tips Premium Courses Member Login My Courses Member Forum Become A Member.

How To Become A Profitable Trader With A 9 To 5 Job — 12 steps Rolf Beginners , Tips , Tradeciety Academy 2 Comments 47, Views.

The Forex Scam: What you must know about Forex online - Google Livres

Contents in this article 1. Find a trading style that fits you and your daily life 2. The most important day for a part time trader with a job is… 4. Active improvement as a trader 5. Get your priorities straight 6. Asking the wrong questions at the wrong time… 7. The dangers of demo trading 9. Forex Trading Academy Forex price action course Private forum Weekly setups Apply Here. Doug August 20, at 4: TheRumpledOne August 20, at 6: Leave a Reply Cancel reply Your email address will not be published.

We are Rolf and Moritz. We have a passion for trading and sharing our knowledge.

We travel the world and hope to inspire. We quit our corporate jobs a few years ago and are now living life the way we want it to be. Our holy grail is hard work and independence. We have a passion for sharing our knowledge of the markets and hope to help other traders improve their trading.

Tradeciety Trading Courses About Us Contact us Free Beginner Courses. Trading Futures, Forex, CFDs and Stocks involves a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results.

Articles and content on this website are for entertainment purposes only and do not constitute investment recommendations or advice. Full Terms Image Credit: Tradeciety used images and image licenses downloaded and obtained through Fotolia , Flaticon , Freepik and Unplash. Trading charts have been obtained using Tradingview , Stockcharts and FXCM. Icon design by Icons8. Imprint Privacy Policy Risk Disclaimer Terms.

Enter your email and get instant access. Please share to spread the word Facebook Twitter Email. We use cookies to ensure that we give you the best experience on our website. The continuous use of this site shows your agreement. Privacy Policy I accept.