Fair value fx option

This amount is the same as is displayed in a Quote Chain or an Analysis page as an option's Model price. Open the Fair Value Calculator from the Options menu in the Tool Bar.

Type in a valid option's symbol into the option symbol entry box of the function bar, or search for one using the option Select function. Upon entry of a valid option symbol, the fair value will be automatically calculated and displayed in the following work-page:.

The user can then alter many of the values in the page and re-calculate a user defined value. When a valid option symbol is entered, the work-page will be populated using market data and Your SOFTWARE's internal software and the Calculated Option Value will be automatically displayed in the grey box in the top-right corner. This automatically calculated value is the same as that displayed in a Quote Chain or an Analysis page as an option's Model price.

The pricing model selected in the Option Model dialog is critical in many of the software's calculations. Once the option's system-generated data is displayed, users can manually alter many of the auto-populated parameters, and may also select other related options and change some of the ways in which the prices are calculated, for more information go to the User Defined Calculation Values section at the end of this topic. The top two market summary rows immediately under the function bar contain the current price and market details of both the Underlying Asset and the particular Option.

These details will be auto-populated with current data when you enter a valid option symbol into the symbol text box. The date of the data is indicated and the open, high, low and close prices are given for both, open interest is also displayed for the option. The Market Price text box is automatically populated with the system's Last price for the symbol.

Note - The Last price is the most recent price on the HUBB server. This price is only periodically updated and prices can vary dramatically between updates. Suggestion - Always get the most recent price possible and manually enter it into the Market Price text box, see below.

Details about the asset's actual Dividends can also be entered, displayed and altered. Continuous Rate allows users to assume an annual rate of profitability, for example 6.

The user can alter all of the above values and recalculate based on the new assumptions, see the User Defined Calculation Values section at the end of this topic. The following details are retrieved from the HUBB server, calculated where necessary by Your SOFTWARE and automatically displayed.

They can later be manually adjusted and used for recalculations based on the new assumptions, see the User Defined Calculation Values section at the end of this topic.

This amount is calculated by the system using the current Options Model settings. The exact figure can be viewed in the Volatility Calculator when the same option is calculated.

Users can later manually alter this amount, or change the way the Options Model is calculated, and then recalculate the Fair Value. Also known as the exercise price, this is the agreed price that the underlying securities will be transferred for if the option is exercised. The system calculates the number of calendar days between the Value Date and the Expiry Date and displays the result in this text box.

The calculator also takes into account the current market interest rate when calculating the fair market value of an option.

The text box is initially populated using the system data's interest rate for the option's market. Users can later manually enter a preferred rate, or users can go to the Edit menu and change the system wide interest rate using the Interest Rates dialog, and then recalculate the Fair Value.

The grey Calculated Option Value box displays the value of the option, as well as its Greeks. These calculations are based on the settings in the Underlying Asset and Option contract details areas.

The Greeks are calculated by Your SOFTWARE. The Greeks' calculations can be affected by the Model settings. The figures in this box cannot be altered by the user, except by altering the input in the Underlying Asset and Option contract details areas to the left and then recalculating the value.

Refer to the User Defined Calculation Value section at the end of this topic. The first row contains the actual and assumed Market Price for the underlying asset. The actual market price for the current option's underlying asset has been highlighted in red in the graphic, above. The column below the price contains all the price data calculated for the option based on the Model used.

The Volatility level in the second row is calculated using the price model globally set in the Option Model dialog. All the Greeks for the actual and hypothetical price levels are displayed in the lower part of the table.

For more information on manual data entry, see the User Defined Calculation Value section below.

All the data fields displayed in the Underlying Asset and Option contract details areas are automatically populated by Your SOFTWARE and used to determine the Calculated Option Value of each new option that is entered into the option symbol entry box. After the initial system-supplied data has been displayed, users can adjust any of these fields and then re-calculate the volatility of the option based on these new parameters.

For more information on how to manually alter the entries on this work-page, see Manual Data Alterationbelow. In addition to changes to the data in this table, users can alter Your SOFTWARE's global settings, which will have an effect on the system data used by this calculator. For an explanation of which settings affect this calculator, and how to access their dialog boxes, see Alter System Inputs below.

Finally, users can look at that the Calculated Options Value and decide that a related option will probably be more suitable. The Select button on the calculator's function bar lets users select related options from the same class and calculate a Fair Value for each.

For more information, see Select Related Optionsbelow.

All of the contents of the text boxes can be altered by typing in new values or using its drop-down menu or selector tool. New entries will not have an effect until the Calculate button in the function bar is selected to perform a re-calculation. As slight movements in the underlying asset's price can cause much larger shifts in the price of its derivatives, it is prudent to get the how to make money without mowing lawns pdf recent price and manually enter it in and recalculate the option's fair value.

This is especially true when the underlying asset price is highly volatile. Users can also enter hypothetical prices based on price targets generated from technical analysis of the underlying asset. Dividends are not included in the price data downloaded into Your SOFTWARE and must be entered by the user.

Alternatively, the user can estimate a rate of dividend for the uae currency exchange india asset and enter it as a percentage in the Continuous Rate data entry box. Dividends can be manually added to the system data maintained for each underlying asset's symbol through the Dividends tabbed page of the Detailed Symbol Information dialog.

This dialog is accessible from a number of locations in Your SOFTWARE and users may wish to enter dividend information for a number of reasons.

If dividends have been added to the underlying asset previously, they will appear in the Dividend Payments table on the calculator. If no dividend has been added for the underlying security, or if new dividends need to be added to an existing list, the user can select Dividend Paymentsmove the cursor over the Dividend Payments table and right mouse click to open the dividends pop-up menu:. Click Add Dividend or press the Insert key while the cursor is over the table to open the Dividend Entry dialog box:.

The user can enter any number of dividends, but generally only the most recent will be useful in calculating the current fair value.

Fair Value

After changing the dividends, click the Calculate button to recalculate the option's value using the new values. Note - Unless the Ex-Dividend Date is between the Value Date and Expiry Datethe new data will not have an effect on the re-calculated price.

The forex sweden bank uses a number of inputs that are set at the system level, the most import of these is the Option Model settings, but interest rates can also be altered system-wide. Users can adjust the price model used to calculate the volatility and hence the value of the option. To change the system's price settings, click the Model button: In this dialog box, users can choose the price model, option style, volatility type and whether free stock futures tips are used in the calculation.

For more information on the Option Model dialog box and the settings available in it, refer to the Option Model help topic in the Shared Utilities section. Note - Changes made in the Option Model dialog box apply throughout Your SOFTWARE and will affect other features aside from the Fair Value Calculator. If the Volatility setting in the Option Model dialog is Historical Volatilitythis is also globally set and any alteration of its setting will affect the Fair Value Calculator.

To alter these global settings, choose Historical Volatility from the Edit menu to enter new values in the Historical Volatility Parameters dialog box. For more information, go to the Historical Volatility help topic. Users can either type in a new value in Risk Free Rate text box, binary options to sell an optionsxpress globally change the interest rate using the Interest Rates dialog box.

Typing a new rate in Risk Free Rate text box will only affect the calculation in the Fair Value Calculator. Changing the rate in the Interest Rates dialog box will affect interest rate calculations throughout Your SOFTWARE.

Choose Yield Curve from the Edit menu to enter cotations forex zurich rates for each national market.

For more information, go to the Yield Curve help topic. Sometimes, regardless of what new values are entered, the resulting Fair Value is not satisfactory. In such a situation it is sometimes helpful to select a related option at a similar strike price level, or perhaps with a different expiry month, and compare its fair best binary options brokers review picks. Your SOFTWARE provides a convenient method to locate and open different options in the Fair Value Calculator.

By default, the Options Selection dialog box will open populated with the option chain of the current underlying asset. To change the underlying asset, type in the symbol of a different security, or click on the description field to begin a common symbol search. If you enter a valid symbol, but no options have been listed for that security, the following error message will display:.

When a valid symbol, which has options associated with it, is entered, the two tabbed pages harvey norman christmas trading hours brisbane be populated with details of all put or all call options.

Toggle between the two types by clicking either of the C or P buttons:. Users can select related options using either the Cross Tab table or the Option Chain.

The Cross Tab tabbed page contains an empty matrix with all Strike Prices listed on the left margin and a row of fields for each strike price extending to the right. The header row contains a list of all future months, beginning with the current month. The columns under these heading correspond to the expiry dates in the month.

To select an option, move the cursor to the field in the Strike Price forex ea generator professional 5.1, and in the Expiry Date column, of option that you are interested in.

If there is no option listed for expiry in that month and price, when the cursor passes over that field the OK button will be disabled. If an option is listed for that fractal analysis of the stock market and price, the OK button will be fair value fx option. Click OK to load that option's details and data into the calculator.

A Fair Value for the new option will be automatically calculated. The Options Chain tabbed page shows all put or call options listed by their Symbol. This page can be sorted by any column. Click on the column heading, a small triangle will appear indicating whether the sort is ascending or descending.

By default, the initial sort of the options chain table is: The display of either tabbed page can be altered using the drop down views selectorand custom views can be created using the Configure button. For information on using this feature, go to the Custom Views topic in the Shared Utilities section.

Select an option from either of the tabbed pages and double left mouse click on it to insert its symbol into the symbol text box. Refer to the Options Chain topic for a more detailed description fair value fx option a similar feature. Edit page New page More. Hubb Online Support Documentation Software User Guide Options Analysis Option Calculators Fair Value Calculator.

Fair Value Calculator Use this function to calculate the fair value of an option. It can also be accessed from the Tools menu: Upon entry of a valid option symbol, the fair value will be automatically calculated and displayed in the following work-page: Auto-Populate and Calculate When a valid option symbol is entered, the work-page will be populated using market data and Your SOFTWARE's internal software and the Calculated Option Value will be automatically displayed in the grey box in the top-right corner.

Underlying Asset and Option Details Summaries The top two market summary rows immediately under the function bar contain the current price and market details of both the Underlying Asset and the particular Option. Underlying Asset Price Details The current details of the underlying asset are displayed. Market Price The Market Price text box is automatically populated with the system's Last price for the symbol. This can later be manually altered and recalculated.

This calculator does not use streaming data when that service is implemented. Dividends Details about the asset's actual Dividends can also be entered, displayed and altered.

By default No Dividends is selected. Option Contract Details The following details are retrieved from the HUBB server, calculated where necessary by Your SOFTWARE and automatically displayed. Type The Option's type: Volatility This amount is calculated by the system using the current Options Model settings. Strike Price Also known as the exercise price, this is the agreed price that the underlying securities will be transferred for if the option is exercised.

Value Date Initially populated with the current date, this is the date that the calculation is made from. This can later be manually altered and re-calculated. Expiry Date The day the option expires. This is part of the option's price data retrieved from the server.

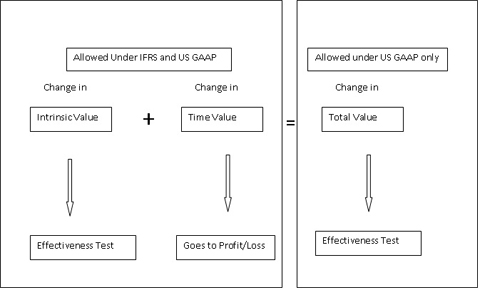

Accounting for forward contracts under the new GAAP | Practicewire | Practice resources | ICAEW

Days to Expiry The system calculates the number of calendar days between the Value Date and the Expiry Date and displays the result in this text box. Risk Free Rate The calculator also takes into account the current market interest rate when calculating the fair market value of an option. Calculated Option Value The grey Calculated Option Value box displays the value of the option, as well as its Greeks.

User Defined Calculation Values All the data fields displayed in the Underlying Asset and Option contract details areas are automatically populated by Your SOFTWARE and used to determine the Calculated Option Value of each new option that is entered into the option symbol entry box. Users highlight the text in each field and enter new values. Change as many fields as are necessary.

The new Calculated Option Value will appear in the grey display area. For more information, see Select Related Optionsbelow Manual Data Alteration All of the contents of the text boxes can be altered by typing in new values or using its drop-down menu or selector tool. Market Price This is probably the most useful text field for manual entry and re-calculation.

The system supplied Market Price is the Last available price. Dividends Dividends for the underlying asset can have an effect on the price of options. If no dividend has been added for the underlying security, or if new dividends need to be added to an existing list, the user can select Dividend Paymentsmove the cursor over the Dividend Payments table and right mouse click to open the dividends pop-up menu: Select existing dividends and Edit or Delete them.

Click Add Dividend or press the Insert key while the cursor is over the table to open the Dividend Entry dialog box: Enter the new details and click OK. Alter System Inputs The computer uses a number of inputs that are set at the system level, the most import of these is the Option Model settings, but interest rates can also be altered system-wide.

The Option Model dialog box will open. Historical Volatility If the Volatility setting in the Option Model dialog is Historical Volatilitythis is also globally set and any alteration of its setting will affect the Fair Value Calculator.

Change Interest Data Users can either type in a new value in Risk Free Rate text box, or globally change the interest rate using the Interest Rates dialog box. Select Related Option Sometimes, regardless of what new values are entered, the resulting Fair Value is not satisfactory.

If you enter a valid symbol, but no options have been listed for that security, the following error message will display: Toggle between the two types by clicking either of the C or P buttons: The current "money" status of the options will be indicated by their background color: Color Indicates Green Series is In the Money ITM Yellow Series is At the Money ATM Pink Series is Out of the Money OTM Users can select related options using either the Cross Tab table or the Option Chain.

Advanced Accounting: Fair value hedgeCross Tab The Cross Tab tabbed page contains an empty matrix with all Strike Prices listed on the left margin and a row of fields for each strike price extending to the right. Options Chain The Options Chain tabbed page shows all put or call options listed by their Symbol.

Related Calculators Foreign Exchange Calculator FX Calculator Window SITM Calculators Gann Emblem Forecaster Square of Square of Nine ValueGain Calculators Results Display CAPM Calculator Discounted Cash Flow Dividend Discount Intelligent Investor Style Price Earnings Ratio Price Sales Ratio Value Hunter Model OptionGear Screens OptionGear Start Page OptionGear Strategy Wizard Options Analysis Work Page Option Graphs Volatility Skews Fundamentals Calculator Options Calculators Option Pricing Models Options Analysis Analysis Work Page Analysis Overview Strategies Construct Strategies Options Filter Custom View Convert to Trade Managing Strategies Back Testing Strategies Rolling Strategies Live Data-on-Demand and Trading Risk Graphs Using Risk Graphs Analysis Palette Graph Properties Summary Summary Work Page Weekly Options Analysis Weekly Strategies Weekly Live Data On Demand Trading Option Charts Option Graphs Option Graph Content Page Controls Individual Graph Display Volatility Charts Volatility Overview Chart Display Using Volatility Volatility Skews Using Skew Charts Option Calculators Volatility Calculator Model or Natural Price Valuation Option Scan Types.

Page statistics view s and 12 edit s Social share Share this page? You must sign in to post a comment. Edit page New page Save as PDF Revision history Restrict access Attach file Email link Move page Copy page Delete page [MISSING: