Oil price shocks and stock market activity sadorsky

Scientific Research An Academic Publisher. Energy Economics, 21, Revisiting the Effect of Crude Oil Price Movements on US Stock Market Returns and Volatility.

Ralph SonenshineMichael Cauvel KEYWORDS: Abnormal ReturnsEvent StudyOil Shocks.

Oil Prices, Volatility, and Shocks: A Survey - Springer

Modern EconomyVol. From mid tooil prices plunged rapidly causing significant volatility in the US and global equity markets.

Sadorsky, P. () Oil Price Shocks and Stock Market Activity. Energy Economics, 21,

belucydyret.web.fc2.com(99) - Open Access Library

This change in crude oil prices occurred after a significant run up in oil prices three to four years earlier. Each change in the growth trajectory of oil prices affects stock market returns.

How and why do oil price shocks affect the oil price shocks and stock market activity sadorsky stock market returns among key sectors of the economy?

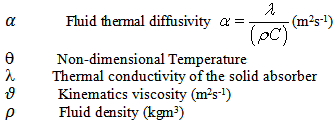

This paper explores this issue by examining how the magnitude of crude oil price changes affects the stock market returns and variances of calforex currency exchange producing, banking and consuming segments of the US economy. Our findings provide some explanations oil price shocks and stock market activity sadorsky the asymmetric responses to positive and negative oil shocks found in these key sectors of the economy.

Home About SCIRP Sitemap News Jobs. Home Articles Journals Books Conferences Services Blog Submit. Information for Authors Paper Submission Manuscript Tracking System Join Peer-Review Program Free SCIRP Newsletter Call for Special Issue Proposals.

Revisiting the Effect of Crude Oil Price Movements on US Stock Market Returns and Volatility AUTHORS: Abnormal ReturnsEvent StudyOil Shocks JOURNAL NAME: