Black scholes put option

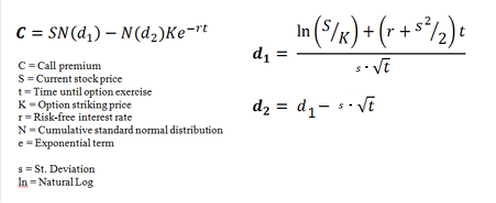

Consider the task of pricing at time 0 a European put option i. The Black-Scholes-Merton pricing formula is.

Free Black-Scholes Calculator for the Price of a Put Option

The other two variables are. It would be nice if we could simply carry out the additions, multiplications, divisions, etc. The situation is a little more difficult than that, however. It is true we can calculate the numerator of the expression for d 1 , using scalar operations where appropriate, and probabilistic operations to add the last two terms together.

Evaluating the price probabilistically could be a major challenge. A different way of presenting the same problem gives the answer without difficulty.

Black-Scholes Formula (d1, d2, Call Price, Put Price, Greeks) - Macroption

The present value of the strike price is just Xe —rT , an expression that involves only one random variable, r , and can be readily computed. To illustrate, Figure 1 shows the distributions of the present values of X and S T.

The present value of the strike price X is narrow because there is not much uncertainty in the risk-free rate r.

In contrast, the present value of the stock price S T is much broader because of its volatility. Distributions of the present values of the final stock value 1 and the strike price 2.

Black–Scholes model - Wikipedia

The difference between the present values can be positive or negative. The put option has a 0 value if the stock price is higher than the strike price. The distribution of the value of the put, given that value is greater than 0, is shown in Figure 2 3. However, the probability of the put option having a non-zero value is only 0. Therefore, the value of the put is 0. Distributions of the present values of the final stock value 1 , the strike price 2 and the benefit from cashing in the put option, if it was positive 3.

Home Growing investment example Option valuation example Bayesian analysis example Underlying theory. Evaluating a Put Option Using Black-Scholes Theory Consider the task of pricing at time 0 a European put option i. Distributions of the present values of the final stock value 1 and the strike price 2 The difference between the present values can be positive or negative.